Applying the Confirmation Principle to Cryptocurrencies

Two earlier analyses (HERE and HERE) demonstrated the effectiveness of the confirmation principle when applied to U.S. stock indexes and bonds, highlighting its value in avoiding trading fakeouts. This principle suggests that a new high or low unconfirmed by another asset or index has a high probability of failing.

Today, I will show you how this principle also applies to the Crypto world. I consider Bitcoin the main asset, and Ethereum the second asset from which I seek confirmation.

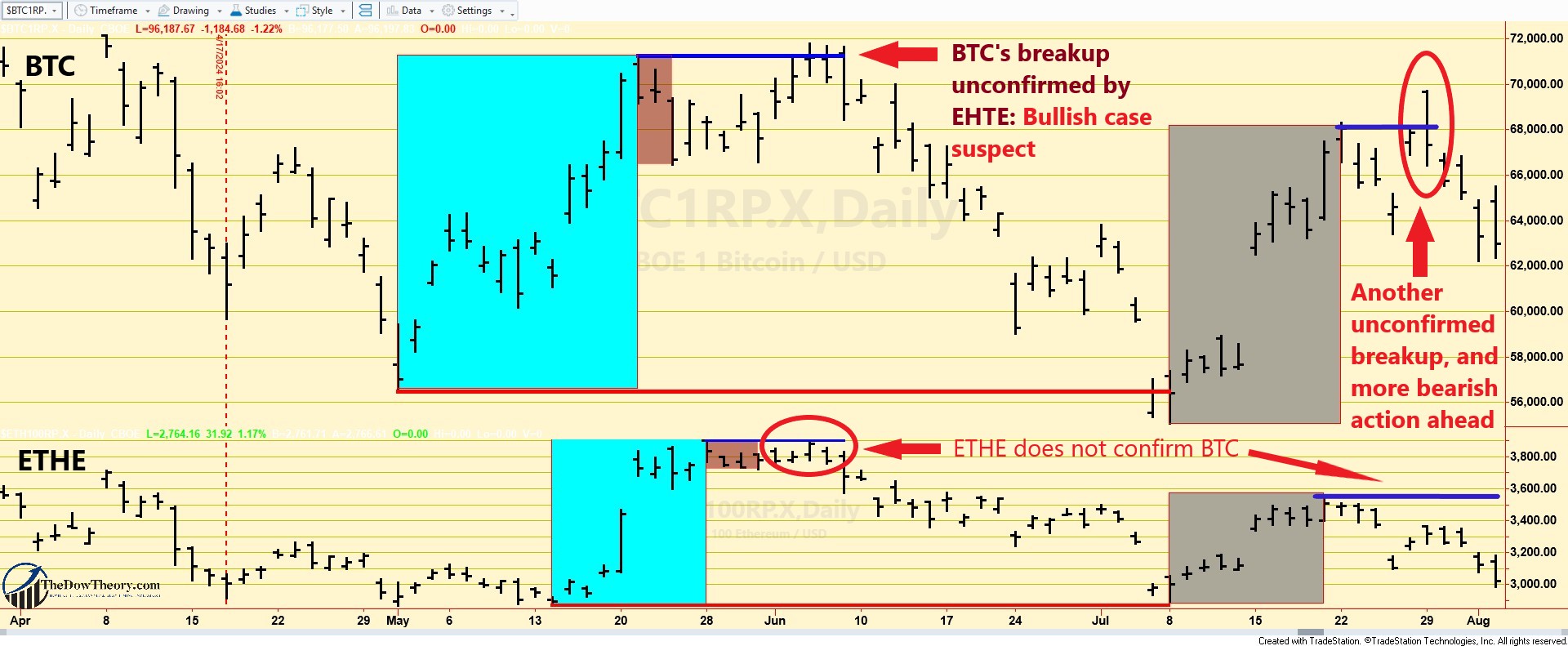

The starting point is the primary bear market that was signaled on4/17/24. Following the 5/1/24 (BTC) and 5/14/24 bear market lows, a rally followed that qualified as a secondary reaction. On 6/5/24, BTC surpassed its 5/1/24 secondary reaction highs, but ETHE did not confirm. In light of this lack of confirmation, the trend remained unaltered and did not transition to bullish, thereby refraining from triggering a Buy signal. Subsequent price movements distinctly leaned toward the bearish, effectively categorizing the earlier breakout as a bull trap. Fortunately, ETHE’s refusal to confirm proved to be our shield.

Incidentally, this situation also presented an excellent opportunity for shorting. The primary trend was bearish at the time, and we always give the benefit of the doubt to the continuation of the primary trend, as trends tend to persist. In this context, the absence of confirmation following a bullish breakout indicated a higher probability of BTC and ETHE arresting their rally and resuming their bearish trend. Around 6/11/24, a prime shorting opportunity materialized: both BTC and ETHE resumed their downward trajectory by violating the 5/31/24 minor lows: This was the sweet spot to sellshort, while our stop-loss in case of a newly confirmed rebound was near our shorting price at the 6/5/24 unconfirmed highs. So, the risk-reward of that trade was excellent. My rule of thumb for covering the short is when the previous bear market lows are approached (5/1/24 in this case).

The accompanying charts illustrate the price movements under discussion. Blue rectangles depict the secondary (bullish) reaction countering the prevailing bear market. Horizontal blue lines mark the secondary reaction highs of May 1, 2024. Grey rectangles highlight an additional rally that fell short of qualifying as a secondary reaction. While Bitcoin surpassed this minor rally high, ETHE failed to confirm. The end result remained consistent: a renewed descent to lower lows.

Therefore, as with bonds and stocks, the principle of confirmation remains a fundamental and valuable aspect of Dow Theory. In a future post, I will explore quantifying the performance benefits of using the principle of confirmation to avoid whipsaws.

Sincerely,

Manuel Blay

Editor of thedowtheory.com